Understanding the Federal Budget Pie Chart

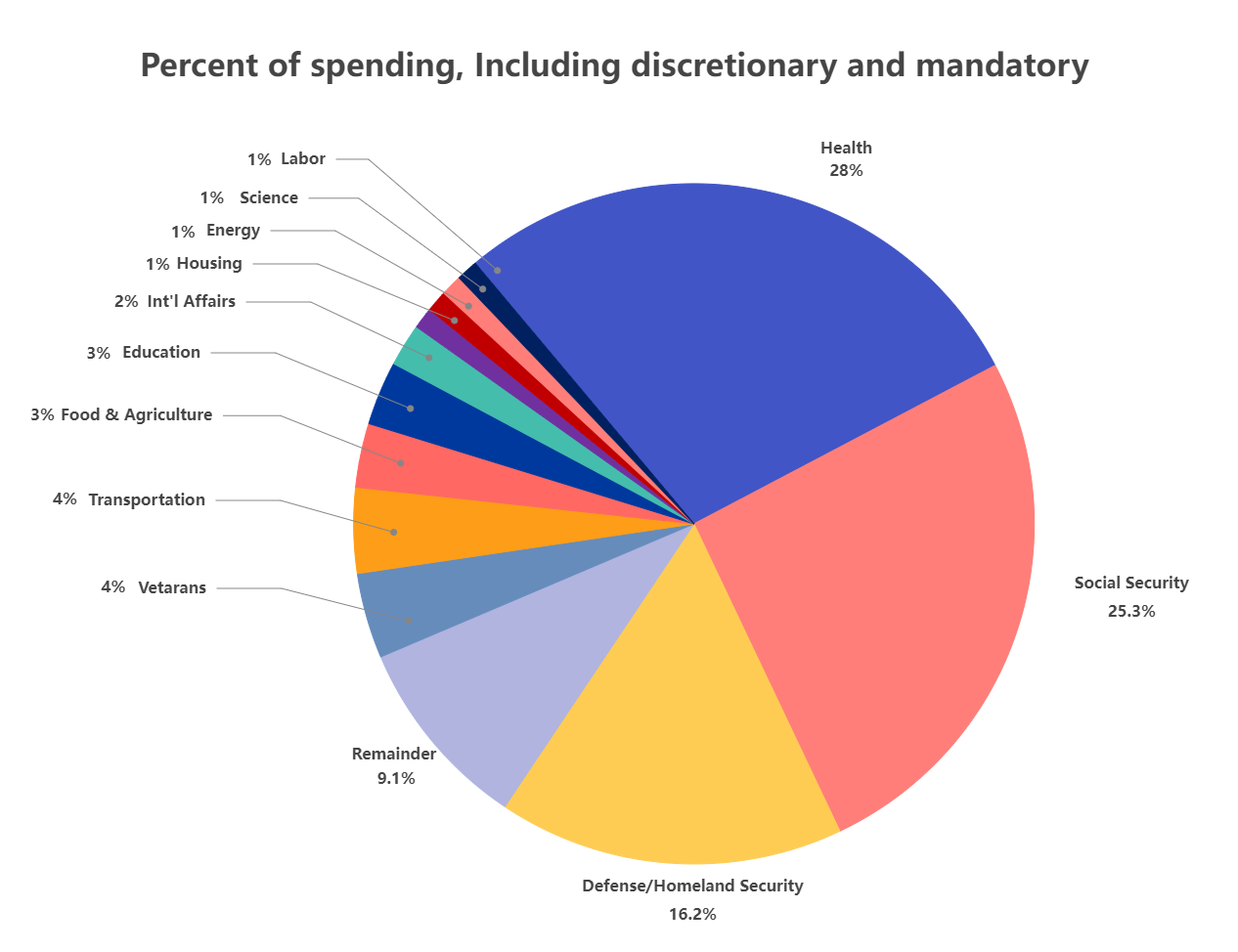

U.S. federal government spending has allocated funds across various categories over the past eight fiscal years (2016–2023). The discretionary budget, determined by Congress through the appropriations process, is allocated for various programs each year, including national defense, education, and transportation. Here’s a summary of the major spending areas:

| Fiscal Year | Total Spending (in trillions) | Major Spending Categories (% of Total Spending) |

|---|---|---|

| 2016 | $3.85 | – Social Security: 24%\ – Medicare: 15%\ – Medicaid and other health programs: 13%\ – Defense: 15%\ – Net Interest: 6%\ – Other: 27% |

| 2017 | $3.98 | – Social Security: 24%\ – Medicare: 15%\ – Medicaid and other health programs: 13%\ – Defense: 15%\ – Net Interest: 6%\ – Other: 27% |

| 2018 | $4.11 | – Social Security: 24%\ – Medicare: 15%\ – Medicaid and other health programs: 13%\ – Defense: 15%\ – Net Interest: 7%\ – Other: 26% |

| 2019 | $4.45 | – Social Security: 23%\ – Medicare: 14%\ – Medicaid and other health programs: 13%\ – Defense: 15%\ – Net Interest: 8%\ – Other: 27% |

| 2020 | $6.55 | – Social Security: 16%\ – Medicare: 12%\ – Medicaid and other health programs: 11%\ – Defense: 11%\ – Net Interest: 5%\ – Other (including COVID-19 relief): 45% |

| 2021 | $6.82 | – Social Security: 19%\ – Medicare: 12%\ – Medicaid and other health programs: 11%\ – Defense: 13%\ – Net Interest: 5%\ – Other (including COVID-19 relief): 40% |

| 2022 | $6.27 | – Social Security: 21%\ – Medicare: 14%\ – Medicaid and other health programs: 11%\ – Defense: 13%\ – Net Interest: 6%\ – Other: 35% |

| 2023 | $6.13 | – Social Security: 23%\ – Medicare: 15%\ – Medicaid and other health programs: 12%\ – Defense: 13%\ – Net Interest: 7%\ – Other: 30% |

Federal Budget Overview

The federal budget is a comprehensive financial plan that outlines the government’s projected income and expenditures for a fiscal year. Prepared by the Office of Management and Budget (OMB) and submitted to Congress for approval, the federal budget serves as a blueprint for how the federal government spends money. It is divided into two main categories: mandatory spending and discretionary spending.

Mandatory Spending: This category includes programs that are funded by law and do not require annual appropriations. Key programs under mandatory spending include Social Security, Medicare, and Medicaid. These programs provide essential services and benefits to millions of Americans, constituting a significant portion of the federal budget.

Discretionary Spending: Unlike mandatory spending, discretionary spending is determined through annual appropriations bills. This category includes funding for national defense, education, infrastructure, and various other federal programs. Discretionary spending is more flexible and can be adjusted based on the federal government’s priorities.

Understanding the distinction between mandatory and discretionary spending is crucial for comprehending how the federal government allocates its resources and addresses national needs.

Federal Revenue and Deficit

The federal government generates revenue through various sources, including individual income taxes, payroll taxes, corporate income taxes, and customs duties. Individual and payroll taxes are the largest sources of federal revenue, providing the bulk of the government’s income.

On the expenditure side, the federal government incurs costs through mandatory spending programs such as Social Security and Medicare and discretionary spending programs like defense and education. Additionally, the government must make interest payments on the national debt.

When the government’s expenses exceed its revenue, it runs a deficit. The deficit is the difference between the government’s total spending and its total revenue. Over time, these deficits accumulate, contributing to the national debt. Understanding the federal deficit and national debt is essential for grasping the broader implications of federal government spending and fiscal policy.

Measuring Government Spending

There are several ways to measure government spending, each providing a different perspective on how the federal government allocates its resources:

- Outlays: This metric measures the amount of money the government spends in a given fiscal year. It provides a clear picture of the government’s expenditures over a specific period.

- Budget Authority: This measures the amount of money Congress authorizes for a particular program or activity. It indicates the maximum amount that can be spent, even if the actual outlays may be lower.

- Obligations: This metric measures the amount of money the government has committed to a particular program or activity. It reflects the government’s financial commitments, regardless of whether the funds have been spent.

By understanding these different metrics, individuals can better understand government spending and how it impacts the federal budget.

Did You Know?

- In fiscal year 2020, federal spending surged to $6.55 trillion, a significant increase from previous years, primarily due to COVID-19 relief efforts.

- Net interest payments on the national debt have steadily increased, reflecting the growing federal debt and rising interest rates.

If This, Then That

- If the federal government continues to run large deficits, then the national debt will continue to grow, leading to higher net interest payments in the future.

- If policymakers implement measures to reduce the deficit, then it could lead to a more sustainable fiscal path and potentially lower interest costs over time.

Frequently Asked Questions

- What is the federal budget? The federal budget is a comprehensive plan that outlines the government’s projected income and expenditures for a fiscal year. It serves as a critical tool for policymakers, enabling them to allocate resources, prioritize spending, and make informed decisions about the nation’s finances.

- What are the main categories of federal spending? The main categories of federal spending are mandatory spending, discretionary spending, and net interest. Mandatory spending includes expenditures required by law, such as Social Security and Medicare. Discretionary spending encompasses expenditures determined through annual appropriation acts, including funding for national defense and education. Net interest represents the government’s interest payments on debt held by the public.

- How does the federal government generate revenue? The federal government generates revenue through various sources, including individual income taxes, payroll taxes, corporate income taxes, and customs duties. Individual income taxes and payroll taxes are the largest sources of federal revenue.

- What is the federal deficit?The federal deficit is the difference between the government’s total expenditures and its total revenue. A deficit indicates that the government is spending more than it is earning, which can lead to an increase in the national debt.

- Why is understanding the federal budget important? Understanding the federal budget is essential because it provides insight into the government’s financial priorities and allocation of resources. It helps policymakers and citizens make informed decisions about the nation’s finances and ensures that resources are used effectively to address national needs.

Conclusion

In conclusion, the federal budget is a complex and multifaceted document that outlines the government’s projected income and expenditures for a fiscal year. Understanding the different categories of federal spending, including mandatory and discretionary spending, is essential for comprehending the budget. Additionally, measuring government spending requires a nuanced understanding of the metrics used to track spending, including outlays, budget authority, and obligations. By understanding these concepts, individuals can better understand the federal budget and its impact on the economy and society.

Related Terms: state and local governments, tax expenditures, refundable tax credits, government spend, federal agency, excise taxes, supplemental appropriations, tax code