Minimum Pay In California: Complete Guide (2025)

Introduction to California’s Minimum Wage System

California’s minimum wage framework is among the most complex and employee-friendly in the United States. With state-level minimums that exceed the federal minimum wage, plus county and city-specific rates that may be even higher, employers must navigate a multi-layered system to ensure proper compensation for their workforce.

This comprehensive guide explains California’s current minimum wage requirements, how they vary by location and employer size, upcoming scheduled increases, and essential compliance information for both employers and employees.

Related Terms: covered employers, half moon bay, full time employment, San Diego, most employers, written request,

1. Current California Minimum Wage Rates (2025)

State Minimum Wage

As of January 1, 2025, the California state minimum wage is:

- $16.50 per hour for all employers, regardless of size

This statewide minimum wage rate represents an increase from previous years when rates varied based on employer size. The state minimum wage is adjusted annually based on the U.S. Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Show Image

Fast Food Industry Minimum Wage

Following the implementation of Senate Bill 1717, fast food workers in California receive a higher minimum wage:

- $20.00 per hour for employees at fast food restaurants with 60 or more locations nationally

This specialized fast food minimum wage applies regardless of the restaurant’s location within California and supersedes lower local minimum wages, though workers must still receive the highest applicable minimum wage if local ordinances exceed $20.00 per hour.

Show Image

Healthcare Workers Minimum Wage

Under Senate Bill 525, healthcare workers now receive enhanced minimum wages:

- $23.00 per hour for workers at healthcare facilities

- $21.00 per hour for workers at other healthcare settings

These healthcare minimum wages apply to clinical, administrative, maintenance, and other support staff working in covered healthcare settings.

Monthly Salary Equivalent

For reference, the monthly salary equivalent of California’s standard minimum wage (based on 40-hour workweeks) is:

- $2,860 per month ($16.50 × 40 hours × 4.33 weeks)

This calculation is useful for salaried employees who must receive at least the minimum wage for all hours worked.

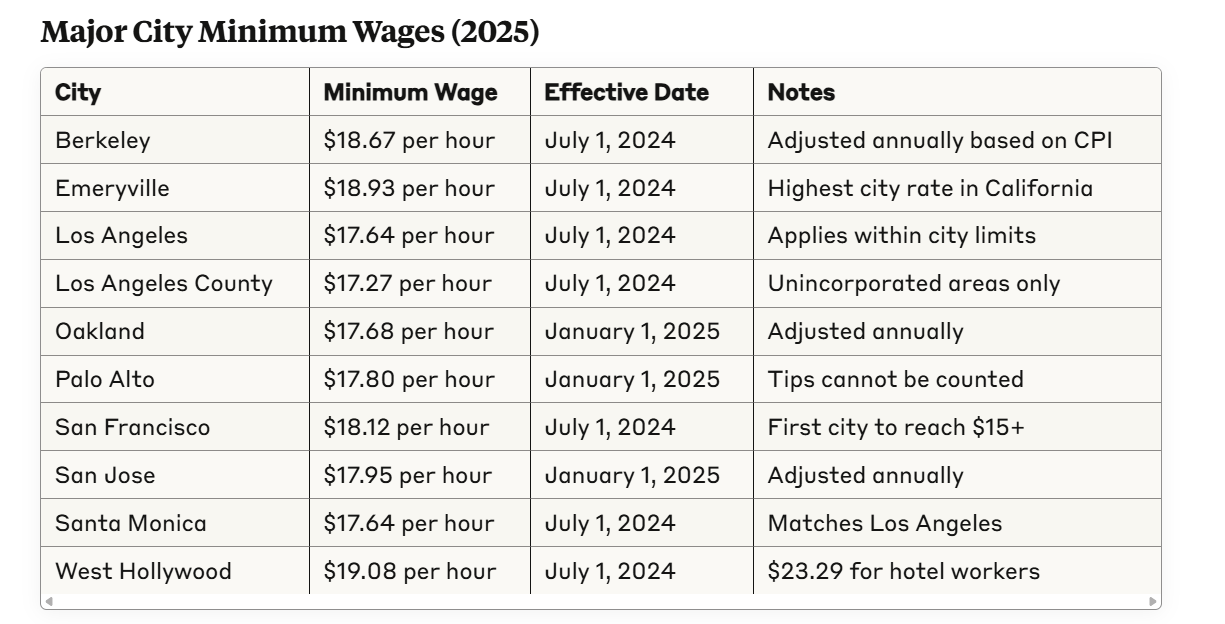

2. Local Minimum Wage Ordinances

Many California cities and counties have established their own minimum wage ordinances that exceed the state minimum. Employers must pay the highest applicable minimum wage rate, whether federal, state, or local.

Major City Minimum Wages (2025)

County Minimum Wages

Several California counties have established minimum wages that apply within their geographic boundaries (typically only in unincorporated areas):

- Los Angeles County: $17.27 per hour (unincorporated areas)

- San Mateo County: $17.06 per hour (unincorporated areas)

- Santa Clara County: $17.55 per hour (unincorporated areas)

- Sonoma County: $17.20 per hour (unincorporated areas)

Industry-Specific Local Rates

Some cities have established higher minimum wage rates for specific industries:

- Hotel Workers:

- West Hollywood: $19.08 per hour

- Santa Monica: $19.73 per hour (hotels)

- Los Angeles: $19.15 per hour (hotels with 150+ rooms)

- Airport Workers:

- San Francisco Airport: $19.45 per hour

- San Jose Airport: $18.85 per hour

3. Exemptions and Special Cases

Not all employees are covered by California’s standard minimum wage requirements. Several exemptions and special cases exist:

Exempt Employees

Certain employees are exempt from minimum wage requirements if they meet specific criteria:

- Executive Exemption: Managers who supervise at least two employees and exercise independent judgment

- Administrative Exemption: Office workers who perform non-manual work related to business operations

- Professional Exemption: Licensed professionals and creative professionals

To qualify for these exemptions, employees must:

- Perform specific job duties that meet exemption requirements

- Earn a salary of at least twice the state minimum wage

- 2025 minimum salary for exemption: $69,784 annually ($5,815 monthly)

Tipped Employees

Unlike federal law, California does not allow a tip credit against the minimum wage:

- Employers must pay tipped employees the full minimum wage per hour

- Tips received are in addition to the minimum wage

- Employers cannot deduct tips from wages

- Mandatory tip pooling is allowed if certain conditions are met

Learners and Trainees

“Learners” (employees in new occupations with no previous similar experience) may be paid:

- No less than 85% of the minimum wage

- Only during their first 160 hours of employment

- Must still receive at least the federal minimum wage ($7.25 per hour)

Show Image

Disabled Workers

Workers with disabilities may be employed under a special license at less than minimum wage only if:

- The California Department of Industrial Relations has issued a license

- The arrangement is part of a rehabilitation program

- The worker’s earning capacity is impaired by physical or mental disability

Minors (Under 18)

Student employees, camp counselors, and other minor employees may have different minimum wage requirements:

- Full-time high school or college students: May be paid 85% of minimum wage in certain retail or service establishments

- Minors under 18 working fewer than 20 hours per week: Regular minimum wage applies

- Minor workers must still receive at least the highest applicable minimum wage for all hours worked

4. Minimum Wage Enforcement and Penalties

The California Labor Commissioner’s Office (Division of Labor Standards Enforcement) enforces minimum wage laws. Violations can result in significant penalties:

Penalties for Minimum Wage Violations

Employers who fail to pay the minimum wage may face:

- Unpaid Wages: Full payment of all wages owed

- Liquidated Damages: Additional payment equal to the unpaid wages

- Waiting Time Penalties: Up to 30 days of wages if final paychecks don’t include all wages due

- Civil Penalties: $100-$250 per violation for first offense

- Additional Penalties: $250-$1,000 per violation for subsequent offenses

Employee Remedies

Workers who have been paid less than minimum wage have several options:

- File a wage claim with the Labor Commissioner’s Office

- File a lawsuit in court for unpaid wages and damages

- Contact the Labor Commissioner’s Office for assistance

Employees have three years from the date of the violation to file a claim for unpaid minimum wages.

Anti-Retaliation Protections

California law prohibits employer retaliation against employees who:

- Assert their minimum wage rights

- File wage claims

- Participate in wage claim investigations or proceedings

If an employer retaliates, employees may be entitled to reinstatement, back pay, and other remedies.

Show Image

5. Employer Compliance Requirements

California employers must follow specific requirements to comply with minimum wage laws:

Required Workplace Postings

Employers must display official posters in conspicuous locations where employees can easily read them:

- Current official minimum wage poster (state version)

- Local minimum wage ordinance notice (if applicable)

- Paid sick leave poster

- Other required labor law postings

These notices must be posted in English and any other language spoken by at least 5% of the workforce.

Record-Keeping Requirements

Employers must maintain detailed payroll records for at least three years, including:

- Employee identification information

- Hours worked each day and total per pay period

- Wages paid, including regular and overtime rates

- Deductions made

- Dates of payment and pay periods covered

Records must be available for inspection by employees upon reasonable request and by the Labor Commissioner.

Paycheck Requirements

Pay stubs must include specific information related to minimum wage compliance:

- Gross wages earned

- Total hours worked (for non-exempt employees)

- All deductions made

- Net wages earned

- Inclusive dates of the pay period

- Employee name and last four digits of SSN or employee ID

- Employer name and address

Failure to provide proper pay stubs can result in penalties of $50-$100 per employee per pay period.

Interaction with Other Labor Laws

Overtime Requirements

California’s overtime law works in conjunction with minimum wage requirements:

- Time-and-a-half for:

- Hours worked beyond 8 in a single workday

- Hours worked beyond 40 in a single workweek

- First 8 hours worked on the 7th consecutive day of work

- Double time for:

- Hours worked beyond 12 in a single workday

- Hours worked beyond 8 on the 7th consecutive day of work

Overtime must be calculated based on the regular rate of pay, which cannot be less than the applicable minimum wage.

Paid Sick Leave

California’s paid sick leave law entitles most employees to:

- At least 24 hours (3 days) of paid sick leave per year

- Accrual at rate of 1 hour per 30 hours worked

- Use sick leave for own illness or to care for a family member

- Be paid at regular hourly rate (at least minimum wage)

Many cities have enacted more generous paid sick leave ordinances.

Meal and Rest Breaks

California employees are entitled to:

- 30-minute unpaid meal break if working more than 5 hours

- Second 30-minute unpaid meal break if working more than 10 hours

- 10-minute paid rest break for every 4 hours worked

If employers fail to provide legally required breaks, they must pay one additional hour of pay at the employee’s regular rate (at least minimum wage) for each day a break violation occurs.

Reporting Time Pay

When employees report to work but are provided less than half their scheduled shift, employers must pay:

- At least two hours of pay at regular rate

- No more than four hours required

This pay cannot be less than the applicable minimum wage for the time the employee is required to report.

Future Minimum Wage Increases

Scheduled State Increases

The California minimum wage will continue to adjust annually based on inflation:

- Increases take effect each January 1

- Based on August-to-August increase in CPI-W

- Limited to 3.5% maximum annual increase

- Rounded to nearest 10 cents

The California Department of Industrial Relations must announce the adjusted rate by October 15 each year.

Scheduled Local Increases

Most local minimum wages adjust annually, typically on either January 1 or July 1:

- January Adjustments: Berkeley, Emeryville, Oakland, Richmond, San Francisco

- July Adjustments: Los Angeles, Los Angeles County, Malibu, Pasadena, Santa Monica

Local rates typically adjust based on the regional Consumer Price Index or a fixed percentage increase.

Potential Legislative Changes

Several minimum wage initiatives are under consideration in California:

- Industry-specific minimum wages for additional sectors

- Further increases to fast food and healthcare minimum wages

- Expanded local authority to set industry-specific wages

- Enhanced enforcement mechanisms

California voters may also see ballot initiatives related to minimum wage in upcoming elections.

Show Image

Special Topics in California Minimum Wage Law

Remote Workers

For employees working remotely:

- The applicable minimum wage is based on the employee’s physical location

- Employers must pay the highest minimum wage for the location where the work is performed

- Employers are responsible for tracking worker locations

This creates compliance challenges for employers with remote workers in multiple California cities.

Multi-City Employers

Employers with operations in multiple California locations must:

- Track where each employee works

- Pay the highest applicable minimum wage for each location

- Maintain records documenting hours worked at each location

- Display appropriate minimum wage posters at each job site

Collective Bargaining Agreements

Some minimum wage ordinances contain limited exemptions for workers covered by collective bargaining agreements if the agreement:

- Explicitly waives the local minimum wage ordinance

- Provides for wages, hours, and working conditions

- Provides a higher total compensation package

These exemptions vary by city and do not apply to the state minimum wage.

Contractors vs. Employees

Only employees (not independent contractors) are entitled to minimum wage protections. However, California’s ABC test for employment status makes it difficult to classify workers as contractors:

Under this test, a worker is presumed to be an employee unless the hiring entity proves:

- The worker is free from control and direction

- The worker performs work outside the usual course of the hiring entity’s business

- The worker is customarily engaged in an independently established trade or business

Misclassifying employees as contractors to avoid minimum wage requirements can result in severe penalties.

Frequently Asked Questions About California Minimum Wage

General Minimum Wage Questions

Q: How does California’s minimum wage compare to the federal minimum wage?

A: California’s state minimum wage of $16.50 per hour is significantly higher than the federal minimum wage of $7.25 per hour. California employers must pay the higher state minimum wage to all employees.

Q: How often does the minimum wage increase in California?

A: The state minimum wage is adjusted annually on January 1 based on inflation (CPI-W). Many local minimum wages are also adjusted annually, either on January 1 or July 1, depending on the city or county.

Q: If I work in multiple cities with different minimum wages, which rate applies?

A: You must be paid at least the minimum wage for the location where you physically perform the work. If you work in multiple locations during a single pay period, your employer must track your hours by location and pay accordingly.

Questions for Specific Types of Workers

Q: I’m a tipped employee. Can my employer pay me less than minimum wage if I earn tips?

A: No. Unlike federal law, California does not allow a tip credit. Employers must pay tipped employees the full minimum wage for all hours worked, regardless of tip income.

Q: I’m paid a salary. Does the minimum wage still apply to me?

A: Yes, unless you qualify for an exemption based on your job duties and salary level. Even salaried employees must receive at least the minimum wage for all hours worked.

Q: Do minimum wage laws apply to undocumented workers?

A: Yes. All labor protections, including minimum wage laws, apply to all employees regardless of immigration status.

Q: I’m a domestic worker (housekeeper, nanny, etc.). Am I entitled to minimum wage?

A: Yes. Domestic workers in California are entitled to receive at least the minimum wage for all hours worked.

Enforcement and Compliance Questions

Q: What should I do if my employer isn’t paying me the correct minimum wage?

A: You can:

- Speak with your employer about the issue

- File a wage claim with the California Labor Commissioner’s Office

- Contact a labor law attorney

- File a lawsuit in court

Q: Can my employer fire me for complaining about minimum wage violations?

A: No. California law prohibits retaliation against employees who assert their minimum wage rights, file complaints, or participate in investigations or proceedings related to minimum wage violations.

Q: How far back can I claim unpaid minimum wages?

A: You generally have three years from the date of the violation to file a claim for unpaid minimum wages in California.

Q: What records should I keep to prove minimum wage violations?

A: Keep records of:

- Hours worked (time cards, personal logs)

- Pay stubs

- Work schedules

- Communications with your employer about wages

- Names of witnesses who can verify your hours

Local Ordinance Questions

Q: How do I know which local minimum wage applies to me?

A: The minimum wage for the city or county where you physically perform work applies. Your employer is required to post notices about the applicable minimum wage. You can also check your city or county’s website or contact your local labor standards office.

Q: My city has a minimum wage ordinance, but I work for a small business. Does the local minimum wage still apply?

A: It depends on the specific ordinance. Some local minimum wage laws exempt very small businesses (typically those with fewer than 25 or fewer employees), while others apply to all employers regardless of size. Check your local ordinance for details.

Q: What if my employer is based outside California but I work remotely from California?

A: California wage and hour laws, including minimum wage requirements, apply to work performed within the state, regardless of where the employer is based.

Conclusion: Navigating California’s Complex Minimum Wage Landscape

California’s multi-layered minimum wage system creates both protections for workers and compliance challenges for employers. With state, county, city, and industry-specific rates—many of which change annually—staying informed about applicable minimum wages is essential.

For employers, implementing robust systems to track employee work locations, hours worked, and applicable minimum wage rates is crucial for compliance. Regular audits of payroll practices and staying updated on minimum wage changes can help avoid costly violations.

For employees, understanding your rights under minimum wage laws and keeping records of your hours and pay enables you to advocate effectively if violations occur. California’s strong worker protections and enforcement mechanisms provide multiple avenues for addressing minimum wage violations.

As minimum wage rates continue to increase and new industry-specific standards emerge, both employers and employees should stay informed about these important workplace rights and obligations.

This guide provides general information about California minimum wage laws as of 2025 but should not be considered legal advice for your specific situation. Always consult with a qualified employment attorney about your particular circumstances.

Related Terms: Hourly minimum wage, state minimum wage laws, minimum wage established, pay employees, labor code section, workers employed, effective date employers, state law, wage standards