How Do I File a Complaint Against a Mortgage Company: A Step-by-Step Guide

Introduction

Dealing with mortgage issues can be stressful; sometimes, companies may use unfair or deceptive practices. Understanding the complaint process is crucial to ensure proper filing and compliance with legal requirements. If you find yourself in this situation, filing a complaint can protect your rights as a consumer. This guide will walk you through filing a complaint against a mortgage company, including where to file, what information to include, and what to expect after filing.

Understanding Your Rights

Before filing a complaint, it’s important to understand your rights as a mortgage borrower. Federal consumer financial laws protect you from various unfair and deceptive mortgage practices, including:

- Discrimination based on race, color, national origin, religion, sex, familial status, or disability

- Failure to provide required disclosures

- Charging excessive or undisclosed fees

- Engaging in abusive foreclosure practices, including the use of illegal tactics by lenders. The FTC takes enforcement actions against such practices to protect consumers.

- Violating loan servicing regulations

Additionally, lawful mortgage lending practices are crucial to ensure compliance with fair housing laws. These laws prohibit discriminatory practices based on race, religion, disability, and other factors, providing equal opportunity in housing transactions.

Where to File Your Complaint

Several federal agencies and organizations accept complaints against mortgage companies. For guidance and procedural requirements, it is important to visit the relevant web pages of these agencies.

1. Consumer Financial Protection Bureau (CFPB)

The CFPB is the primary federal agency responsible for enforcing consumer financial laws.

How to file:

- Visit the CFPB’s complaint website: https://www.consumerfinance.gov/complaint/

- Call toll-free: 1-855-411-CFPB (2372)

2. Federal Trade Commission (FTC)

The FTC handles complaints related to deceptive or unfair business practices.

How to file:

- Use the FTC Complaint Assistant: https://www.ftccomplaintassistant.gov/

- Call toll-free: 1-877-FTC-HELP (382-4357)

3. Department of Housing and Urban Development (HUD)

HUD handles complaints related to housing discrimination and FHA-insured loans.

How to file:

- Visit HUD’s complaint page: https://www.hud.gov/program_offices/fair_housing_equal_opp/online-complaint

- Call toll-free: 1-800-669-9777

4. State Regulatory Agencies

Many states have their agencies that regulate mortgage companies and accept consumer complaints. Mortgage loan originators play a crucial role in this process, as they must comply with state licensing and regulatory standards. Procedures for filing complaints against these professionals are in place to ensure proper licensing and address consumer grievances.

How to find your state agency:

- Visit the Nationwide Multistate Licensing System (NMLS) Consumer Access website: https://www.nmlsconsumeraccess.org/

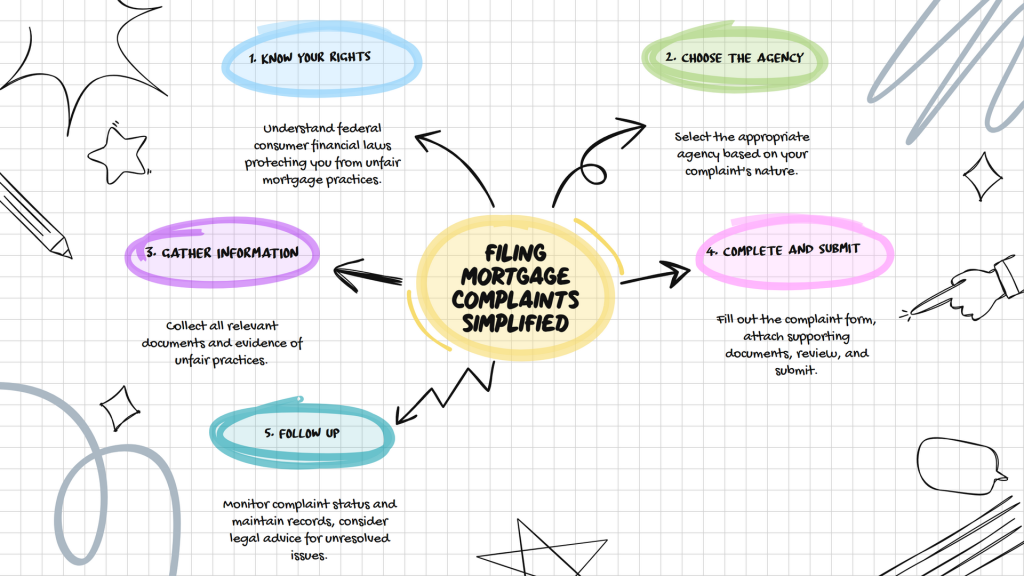

Steps on How to File Complaint Against Mortgage Company

- Gather Information: Collect all relevant documents, including loan agreements, correspondence with the mortgage company, and any evidence of unfair practices.

- Choose the Appropriate Agency: Based on the nature of your complaint, select the most relevant agency from the options above.

- Complete the Complaint Form: Provide detailed information about your issue, including:

- Your personal information

- The mortgage company’s information

- A clear description of the problem

- Any actions you’ve already taken to resolve the issue

- Your desired resolution

- Submit a Written Complaint: It is crucial to submit a signed, written complaint directly to the mortgage company involved. This formal step is often required for regulatory investigations and ensures that the company is aware of your issue and expected to respond within a specific timeframe.

- Submit Supporting Documents: Attach copies of relevant documents to support your complaint.

- Review and Submit: Double-check all information for accuracy before submitting your complaint.

- Keep Records: Save a copy of your complaint and any confirmation numbers or reference codes provided.

What Happens After You File

After submitting your complaint:

- The agency will review your complaint to ensure it’s complete. Regulatory bodies, such as the FTC and the Georgia Department of Banking and Finance, play a crucial role in protecting consumers from deceptive practices in the mortgage industry.

- The complaint will be forwarded to the mortgage company for their response.

- The company generally has 15-60 days to respond, depending on the agency and nature of the complaint.

- You’ll be notified of the company’s response and have an opportunity to review it.

- If you’re unsatisfied with the resolution, you may be able to dispute the outcome or seek additional assistance.

Tips for Effective Complaints

- Be clear and concise in describing your issue.

- Stick to the facts and avoid emotional language.

- Clearly state your desired outcome.

- Follow up regularly on the status of your complaint.

- Consider seeking legal advice if your issue remains unresolved.

Conclusion

Filing a complaint against a mortgage company can be an effective way to address unfair or deceptive practices. By understanding the process and your rights, you can take proactive steps to protect your interests as a mortgage borrower. Remember, federal and state agencies help consumers like you navigate these complex issues and ensure fair treatment in the mortgage industry.