Find The Best Attorney For Homeowners Insurance In CA

This guide will empower you to make informed decisions in the search for an experienced insurance settlement attorney in California. Finding the right legal professional can greatly impact your case’s outcome, helping you secure the maximum compensation you’re entitled to. You’ll learn practical steps to assess potential attorneys, ensuring they have the right experience, track record, and client-focused approach. Equip yourself with the knowledge needed to protect your interests and navigate the complexities of insurance settlements with confidence. Many attorneys offer a free consultation, allowing you to get expert advice on your homeowners insurance claims and bad faith insurance practices without any upfront costs.

Key Takeaways:

- Research extensively about potential attorneys by checking reviews, ratings, and testimonials to gauge their reputation.

- Experience is vital; choose an attorney specializing in insurance settlement cases with a proven track record.

- Consultation services can provide insight into the attorney’s approach and compatibility with your case needs.

- The fee structure should be transparent; discuss payment terms to avoid surprises later in the process.

- Communication is key; select an attorney who prioritizes regular updates and is responsive to your questions.

How to Identify Your Needs

Before you start searching for an insurance settlement attorney, it’s crucial to identify your specific needs. Understand the complexities of your case and determine what you expect from the attorney you choose. Reflecting on these factors will help you effectively communicate your expectations and find an attorney who can best serve your interests.

Evaluate Your Specific Insurance Claims Case

Evaluate the unique aspects of your homeowners insurance claim, including the type of claim involved and the amount of compensation you are seeking. Knowing these details will help you narrow down potential attorneys who have relevant experience and a proven track record in similar cases.

Determine the Type of Attorney Required

Your choice of attorney should align with the specific nature of your case. Understanding your homeowners insurance policy can help you choose the right attorney. Whether you require assistance with a personal injury claim, property damage dispute, or policy denial, each situation may necessitate a different area of expertise.

Needs differ based on circumstances, so it’s crucial to seek out an attorney who specializes in your type of insurance case. Look for one with experience in negotiations and litigation specific to your situation, as knowledgeable attorneys can significantly impact the final settlement. A thorough understanding of the insurance industry, alongside robust negotiation skills, will help secure the best possible outcome for you.

Tips for Researching Potential Attorneys

If you are looking for the best insurance settlement attorney in CA, thorough research is crucial. Consider the collective experience of the legal team when researching potential attorneys. Start by checking for credentials and experience in handling similar cases. Look for reviews from previous clients to gauge their reliability and success rate. Consider the attorney’s communication style and availability. You can also verify their licensing through the State Bar of California. Make a list of potential candidates and narrow it down based on these criteria. Thou shall prioritize your choices by scheduling consultations to find the right fit for your specific needs.

Use Online Resources Effectively

Researching potential homeowners insurance lawyers online can yield valuable insights. Start with reputable legal directories and review platforms to gather information about various insurance settlement attorneys in your area. Focus on attorneys with consistent positive feedback and successful case outcomes. Engage with their websites to understand their specialties and approach to client service. This online research is a powerful tool in making an informed decision.

Seek Recommendations from Trusted Sources

Resources such as friends, family, and colleagues can provide valuable recommendations when searching for an attorney. The personal experiences of those you trust can help you identify reputable homeowners insurance attorneys who have successfully represented others in similar situations. Keep in mind that firsthand accounts often offer a perspective you won’t find in online reviews, giving you insights into the attorney’s skills, communication style, and overall effectiveness. Their recommendations can assist you in compiling a shortlist of potential candidates you can explore further.

Factors to Consider When Choosing an Attorney for Insurance Disputes

Now, when selecting the right attorney for your insurance settlement case, it’s imperative to evaluate several key factors. Consider the attorney’s experience, communication style, and approach to handling cases.

- Experience in handling similar cases

- Reputation within the legal community

- Availability to meet your needs

- Fees and payment structure

Thou should ensure that the attorney you choose aligns with your specific requirements and expectations.

Experience with Insurance Settlements

Clearly, the more experience an attorney has with insurance settlements, the better they can navigate the complexities of your case. An attorney who has dealt extensively with insurance policies understands the intricacies involved, including negotiation tactics and legal strategies tailored to maximize your settlement. They will be adept at identifying the weaknesses in the insurance company’s position, which can lead to more favorable outcomes.

Track Record of Successful Outcomes

Outcomes play a significant role in your decision-making process. When evaluating potential attorneys, assess their history of successful resolutions in similar cases. It is crucial to consider their experience with bad faith insurance practices, as this can significantly impact the handling of your claim. A proven track record can indicate their ability to effectively advocate for clients and achieve desirable settlements.

Settlements are the focal point of your case, and an attorney’s history of successful outcomes can greatly influence your experience. A lawyer who has consistently secured favorable rulings or settlements for clients demonstrates not only their legal acumen but also their commitment to your case.

High-profile cases and positive client testimonials can further validate their expertise, making it imperative for you to thoroughly investigate their past results before making your choice.

How to Conduct Interviews with Attorneys

Once again, conducting interviews with potential attorneys is a vital step in

finding the best representation for your case. It is crucial to discuss coverage details during the interview to ensure comprehensive protection. This process not only helps you gauge their qualifications but also allows you to assess their compatibility with your needs. Approach these interviews with an open mind and a clear agenda to maximize their effectiveness and ensure you find the right fit for your insurance settlement case.

Prepare Relevant Questions

While preparing for these interviews, it’s important to develop a list of relevant questions that will help you evaluate the attorney’s experience. Ask about their experience with punitive damages in insurance cases, particularly how they handle claims where the insurance company has acted in bad faith. Focus on their expertise in insurance settlement cases, their success rates, and their strategies for handling settlements. An informed conversation will provide insight into their suitability for your needs.

Assess Communication Style and Comfort

Style is an integral part of the attorney-client relationship. During the interviews, pay attention to how the attorney communicates with you and whether you feel comfortable asking questions. It is crucial to discuss how the attorney handles wrongfully denied claims, as this can significantly impact your case. A positive attorney will listen attentively, provide clear answers, and communicate openly about your case and legal options. Ensure that you can envision a productive partnership, as your comfort level will greatly influence your working relationship and the complexities of your case.

Conduct a thorough assessment during your conversations. Take note if the attorney uses jargon that leaves you feeling confused or if they seem disinterested in your concerns; such behaviors can indicate potential issues down the line. You want to engage with someone who demonstrates a genuine interest in your case and shows empathy toward your situation. A good communication style will foster a strong working relationship, ultimately benefiting your case.

Understanding Fees and Contracts

Understanding the complexity of legal fees and contracts is imperative in homeowner’s insurance cases before choosing your insurance settlement attorney. You want to ensure that you’re not only comfortable with the proposed fees but also that you clearly understand the terms of your agreement. Taking the time to discuss fees upfront can help avoid any unpleasant surprises later in the process.

Discussing Payment Structures

Structures of payment can vary widely, and you should familiarize yourself with the different options available. It is also important to understand the fees related to personal property claims, as these can significantly impact your overall costs. Some attorneys work on a contingency fee basis, meaning they only get paid if you win your case, while others may charge hourly rates or flat fees. It’s imperative to inquire about any additional costs that may arise and clarify when payment is expected.

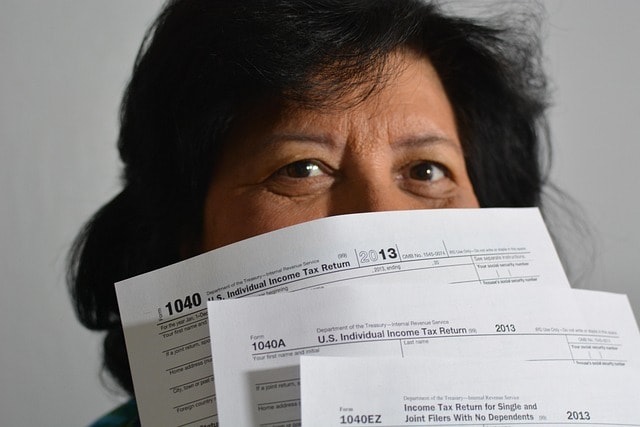

Reviewing the Attorney’s Contract

Assuming you’ve discussed payment structures, it’s time to closely examine the attorney’s contract. This document outlines the terms of your agreement, including fees, services provided, and any responsibilities on your part. It is crucial to understand contract terms related to water damage claims, as this knowledge can expedite the repair process and protect your rights when dealing with insurance claims. Pay attention to the fine print as it can contain important details regarding payment deadlines and additional costs you might incur. Understanding this contract is vital to ensuring you are not locked into unfavorable terms or hidden fees that could jeopardize your case.

This contract review should be a thorough process to help you protect your interests. Look for termination clauses, which indicate how either party can end the agreement, and be sure any promises made verbally are reflected accurately in writing. Ensure you understand what happens if your case doesn’t succeed. Finding an attorney whose terms align with your expectations can help foster a positive working relationship and ultimately improve your chances of a successful outcome.

Related Terms: insurance provider, coverage, contact, covered