Did Donald Trump Engage in Real Estate Fraud?

Real estate fraud refers to illegal activities that take advantage of the real estate market for financial gain through deception and manipulation. It can take many forms, from mortgage fraud to flipping schemes to predatory lending practices. With real estate being such a major asset and avenue of wealth creation for many, it unfortunately also attracts unscrupulous individuals looking to exploit others. Being aware of the common types of real estate fraud can help protect yourself when buying, selling, or investing in property.

NEW YORK (AP) — A judge ruled Tuesday that Donald Trump committed fraud for years while building the real estate empire that catapulted him to fame and the White House, and he ordered some of the former president’s companies removed from his control and dissolved.

Real Estate Transactions

Real estate transactions involve the buying, selling, or transferring of property ownership. They require extensive documentation, diligent verification, and compliance with laws to ensure ethical business practices. Here are some key aspects of real estate transactions that, if corrupted or abused, can constitute fraud:

Property Listings – Real estate agents or sellers provide listing details like home size, age, amenities, condition, etc. Intentionally omitting problems like prior water damage or pest infestations can qualify as fraud by deception. Inflating square footage or amenity claims (e.g. claiming 3 full bathrooms when there is only 1) also misleads buyers.

Inspections – Sellers must disclose any known defects uncovered in inspections. purposefully hiding issues identified in the home, pest, or other inspections are unlawful. Some sellers falsify documentation to pose as inspection companies and provide fraudulent “clean” reports.

Appraisals – Lenders require appraisals to value properties before mortgages are issued. Appraisers may collude with realtors or sellers to over-value properties by hundreds of thousands of dollars to facilitate deals. Inflated appraisals become mortgage fraud.

Title Transfers – Title fraud can occur via forging deeds, exploiting gaps in title records, or preventing proper deed transfers after sales. Title insurers sometimes also intentionally delay title searches to keep premiums while inhibiting buyers’ ownership claims.

Commissions & Payoffs – Real estate agents, attorneys, or title officers can embezzle commission payments, mortgage payoffs, property sale proceeds, or other transaction funds intended for other parties. This illegal theft compromises transactions.

Closing Disclosures – Illegally concealing seller fees, mortgage terms, rate changes, balloon payments, etc. from buyers at closing constitutes fraud via deception. Bogus fees may also be snuck into closing documents.

Down Payments – There are instances where real estate agents have stolen buyer down payments intended for escrow, or where sellers receive down payments but still mortgage 100% of the home price. These acts violate contractual sale terms.

With hundreds of billions of dollars entrusted to real estate professionals during sales, thorough oversight and diligence are essential to prevent transaction fraud. States investigate and prosecute such misconduct under laws like theft by deception, forgery, wire/mortgage fraud, and criminal breach of contract.

Oversight of Real Estate Transactions

Proper oversight and regulation of real estate transactions help guard against the various forms of fraud and abuse that can transpire during property sales, purchases, and transfers of ownership. Here are some key oversight measures:

Licensing – Real estate professionals like brokers and agents must pass licensing exams and meet experience requirements to conduct business and manage transactions. Periodic license renewals and continuing education also help maintain competence and ethical awareness.

Record Keeping – Extensive documentation like property listings, inspection reports, appraisals, title records, buyer disclosures, purchase agreements, etc. create paper trails that promote transparency in transactions. State regulators can review documentation to identify any misconduct.

Disclosures – Sellers must make written disclosures of known defects, liens, boundary issues and more. Agents and attorneys are also obligated to disclose facts material to transactions to all parties. Violating disclosure duties often constitutes legal fraud or misrepresentation.

Trust Accounts – Client funds like down payments and deposits must be held in regulated trust or escrow accounts. This prevents unethical commingling or theft of transaction monies. Regulators examine account records and activity for any signs of misuse.

Reporting – Banks, consumers, real estate professionals and others can refer suspect activities by agents, appraisers, closing officers, etc. to state licensing bureaus for investigation. Reporting fraud helps strengthen oversight.

Penalties – Regulators can impose fines, license suspensions, continuing education mandates, and license revocations against professionals who violate real estate practice regulations. Harsher criminal penalties like imprisonment may also apply in fraud cases.

No system can prevent all unscrupulous behavior, but prudent oversight measures and reporting channels empower regulators to better enforce ethical real estate conduct. These help counterbalance profit motives with duties of honesty and fairness during property transactions. Oversight plays a key role in deterring fraud and abuse in real estate markets.

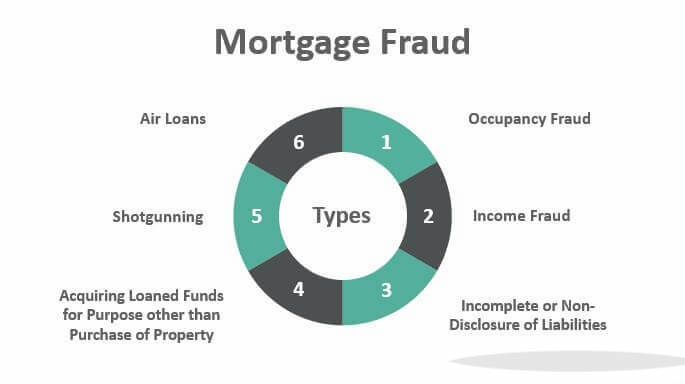

Mortgage Fraud

One of the most common forms of real estate fraud is mortgage fraud. This involves providing false information on a mortgage application to qualify for a loan that otherwise would not have been approved. Common mortgage fraud tactics include:

- Overstating income or assets to appear qualified for a larger loan amount. This can be done by fabricating pay stubs, bank statements, or W-2 forms.

- Lying about employment status, such as claiming a fake job title or employment at a nonexistent company.

- Not disclosing all debt obligations, leaving off credit cards or other loans to appear like a lower-risk borrower.

- Providing fake tax returns to overstate income. Forged or fraudulent tax documents are a key tool in many mortgage fraud schemes.

- Using false property appraisals to make a property seem worth more than it really is. Dishonest appraisers sometimes assist with inflating property values.

The motivation behind mortgage fraud is usually either greed, desperation, or both. Greedy borrowers exaggerate their financials to purchase homes they can’t really afford. Desperate borrowers who truly need financing but don’t qualify legitimately resort to fraud just to get a home loan approved.

Mortgage fraud became notoriously common in the lead-up to the 2008 financial crisis, with many subprime mortgages based on misleading or false borrower information. Lenders have since tightened standards, but mortgage fraud remains an ongoing issue. The FBI estimates that losses from mortgage fraud total in the billions of dollars each year.

Real estate agents play an important role in facilitating property transactions, but sometimes a minority engage in unethical or illegal practices that constitute real estate fraud.

Licensed real estate agents have a fiduciary duty to represent their client’s best interests at all times during a transaction. However, greed may motivate some agents to deceive their own clients or other parties to a transaction. For example, an agent may recommend the buyer purchase a certain residential property without disclosing defects they are aware of just to secure a commission. Or they may engage in mortgage fraud by falsifying a buyer’s income details to help them qualify for a larger mortgage loan from a bank.

Another common real estate scam occurs when agents collaborate with property appraisers and mortgage lenders to artificially inflate a home’s value. This enables the buyer to qualify for a larger mortgage loan than they can actually afford over the long term. Once mortgage payments become unaffordable, the buyer defaults and risks foreclosure.

Real estate fraud occurs in many forms but often involves deceiving parties to a transaction or compromising information that should be fully disclosed and transparent. Ethical agents refuse to mislead clients or falsify figures and details that influence transactions. However, greed leads some agents to participate in real estate scams that ultimately harm buyers, sellers, banks, and the overall housing market. Strict licensing requirements and oversight aim to deter such unethical conduct by real estate agents during the course of their duties.

Flipping Fraud

Property flipping refers to buying houses, usually distressed properties, doing minor renovations or repairs, then quickly reselling them at an inflated price. While not inherently illegal, flipping fraud occurs when unscrupulous flippers use deceptive tactics to sell properties for far more than they’re worth.

Some common flipping fraud practices include:

- Intentionally hiding major defects in a property, such as serious structural issues, mold and pest infestations, roof damage, etc. These problems get covered up with cosmetic makeovers.

- Falsely advertising extensive renovations when only minor facelifts were actually done, like new appliances and paint when the home still needs major plumbing and electrical work.

- Securing inflated appraisals to make a property seem worth more than it is. Dishonest appraisers may work in concert with flippers.

- “Double escrows” where the same property gets “sold” simultaneously to two different buyers at inflated prices without disclosure.

- Selling and assigning the same property contract multiple times to different buyers without their knowledge. This involves changing the purchase contract buyer name and reselling.

Flippers engaging in this kind of fraud prey on unsuspecting home buyers who end up drastically overpaying for properties with serious underlying issues. It has contributed to housing market bubbles forming and then bursting.

Predatory Lending

Predatory lending refers to unethical lending practices that manipulate borrowers into accepting loan terms that are unfavorable or they can’t actually afford. It often targets certain demographics like minorities, the elderly, or those with poor credit.

Some common predatory tactics include:

- Charging excessive fees and interest rates far beyond what the borrower’s credit risk merits.

- Misleading borrowers about the mortgage terms. The true costs and interest rates are hidden or obscured.

- Pressuring borrowers into frequent refinancing, resulting in higher origination fees each time.

- Convincing borrowers to accept adjustable-rate mortgages without explaining the ramifications of interest increases.

- Getting borrowers to take out larger loans than needed by convincing them they can afford a more expensive property.

- Targeting vulnerable groups like the elderly or minorities for the most deceptive practices based on the assumption they’re less financially savvy.

Predatory lenders thrive on the lack of financial literacy among many borrowers. Their sole goal is making as much profit as possible even if the borrower clearly cannot afford the loan terms.

Real Estate Investment Frauds

Real estate investing scams prey on those looking to grow their money through property. Investment fraud comes in several major forms:

Ponzi Schemes – Investors are promised generous returns from their property investment, but in reality, earlier investors are paid off with money from newer investors. The whole operation is a fraud reliant on new money constantly coming in. Usually no actual profit-generating investments exist. The scheme implodes once new investment dries up.

Overvalued Property – Unscrupulous real estate investment companies falsely inflate the value and potential profits of their properties to sell investment shares. In reality, the properties are not worth nearly what investors are led to believe. Property values are often distorted using dishonest appraisals.

Misuse of Funds – Developers promote real estate projects and collect substantial investments to fund said projects, but then siphon off investor money into their own pockets or other ventures. The promised projects rarely materialize.

Unlicensed Sellers – Illicit real estate investment companies fail to properly register and obtain the licenses required to legally solicit outside investors. An absence of proper registration is a big red flag when considering real estate investments.

With promises of high returns and money flows, real estate investing scams frequently attract inexperienced investors duped by the prospect of large profits. But in many cases, the investments are overhyped or even completely fictional.

Title Fraud

Title fraud refers to illegally tampering with the deed, title, or ownership documents of a property to essentially steal and assume ownership. This is done through forgery, falsifying paperwork, or exploiting vulnerabilities in the property title recording system.

Some common title fraud methods include:

- Recording forged or fabricated documents to transfer property ownership without the actual owner’s knowledge.

- Filing a false lien against a property, then attempting to seize ownership when lien payments aren’t made.

- Exploiting gaps or lapses in property title records to gain control, such as if no deed was officially filed upon a previous owner’s death.

- Falsifying notary stamps, powers of attorney, or deeds to appear as authorized property representatives and sell without actual owner consent.

Once ownership is illegally assumed, the fraudster can then sell the property and pocket the proceeds. In some cases, they even take out loans against the property and extract equity before the rightful owner even realizes what transpired.

Title fraud often capitalizes on property owners not vigilantly monitoring title documents for any sudden changes. It also underlines the importance of title insurance when purchasing real estate.

Real Estate Transaction Fraud

Shady real estate agents, attorneys, and settlement officers sometimes use their trusted positions to perpetrate fraud during sales and purchase transactions. Some ways they may engage in misconduct include:

- Pocketing portions of down payments or deposits rather than transferring them to escrow accounts as required.

- Embezzling funds at closing that were intended for payoffs, title fees, recording fees, etc.

- Secretly collaborating with other parties in the transaction to increase costs/fees and collect a portion of the excess amounts.

- Failing to disclose known property defects or other material facts that could unlawfully dissuade buyers.

- Illegally inflating their own commissions or kickbacks as part of the transaction without client knowledge.

While relatively rare, real estate transaction fraud undermines the consumer trust and integrity of the housing market. States are increasingly tightening regulations around real estate sales practices to deter this kind of fraud.

Real Estate Brokerage Fraud

Real estate brokers and agencies must also abide by ethical business practices and local real estate laws. Sometimes brokerages engage in unlawful activities like:

- Misrepresenting what services they will provide clients during a transaction.

- Making false promises to potential sellers about how much their home will sell for.

- Not presenting purchase offers in a timely manner to purposefully delay sales.

- Intentionally steering clients toward or away from certain properties, neighborhoods, etc. based on illegal factors like race, religion, family status, disability, etc.

- Operating without proper licensing, insurance, or mandated oversight required in their state.

- Colluding with other brokerages to fix commission rates, fees, or even specific property prices within a market.

While regulators oversee brokerage conduct, few consumers realize they can report unethical practices directly to their state real estate commission. This can trigger disciplinary action against the brokerage or agent if misconduct is uncovered.

Mortgage Closing Fraud

Mortgage closings require extensive documentation, disclosures, and paperwork. Unfortunately, this complexity also creates opportunities for those handling the closing to commit fraud in several ways:

- Failing to properly disburse mortgage payoff funds to clear prior mortgage liens, allowing two separate loans on the property.

- Intentionally delaying new mortgage recordings so they appear subordinate to other liens filed in the interim.

- Secretly facilitating “double closings” where a property is sold simultaneously to more than one buyer.

- Forging or improperly documenting information on closing documents like HUD-1 Settlement Statements.

- Not providing legally mandated disclosures to buyers regarding loans, property conditions, etc.

- Charging unlawful fees or incorrectly reporting closing figures to cause discrepancies.

To prevent closing fraud, consumers should scrutinize all documents, ask questions about unclear details, and immediately report suspected misconduct. States also closely oversee the licensing and conduct of mortgage officers who handle closings.

Home Equity Fraud

With home values skyrocketing in recent decades, equity fraud has become a prime target for swindlers. Home equity scams often focus on seniors, minorities, or vulnerable groups. Some common ploys include:

- Offering phony home improvement or repair services that require signing over property access and equity. No services materialize, and the scammer steals extracted equity.

- Peddling false “foreclosure rescue” assistance that involves deeding or transferring property titles. Victims lose their home equity and ownership rights.

- Marketing predatory reverse mortgages that charge excessive fees, rapidly drain equity, or come with hidden terms that cause defaults.

- Pressuring seniors to invest equity in shady financial products, timeshares, vacation plans, etc. that eventually evaporate or prove fraudulent.

- Misleading borrowers that home equity loans or lines will have few consequences when in reality, they can trigger financial distress and foreclosure.

Home equity scammers aim to siphon equity, evade repayment, and ultimately gain property or cash. Never sign over your deed or property access rights without trusted legal guidance.

Property Tax Fraud

Another form of real estate fraud involves illegally avoiding property tax obligations. Tactics may include:

- Lying on tax exemption applications to avoid paying any property taxes at all.

- Contesting one’s home value assessment every tax period to continuously lower taxes owed.

- Transferring property ownership to various LLCs or trusts to obscure tax liability.

- Failing to report improvements, additions, or other changes that increase property value and taxes owed.

- Reporting one property address to tax authorities while actually owning and living at another address.

While some methods exploit legal loopholes, outright property tax fraud cheats municipalities of billions in much-needed revenues. Authorities are dedicating more resources to uncovering schemes through audits and higher penalties.

How Donald Trump Engaged in Real Estate Fraud

Donald Trump, business magnate and former President, has faced frequent allegations of unethical and even illegal real estate practices over his decades-long career. While he has never been convicted of real estate fraud, he has faced multiple lawsuits, regulatory actions, and criticism over suspicious property dealings.

Inflating Asset Values

A common theme throughout Trump’s real estate career has been artificially inflating the value of his properties and net worth. Some examples:

- He claimed his Trump Tower triplex apartment was 30,000 square feet when it was actually only 10,996 square feet according to city records. This allowed him to grossly overstate its value.

- Valuing his Mar-a-Lago resort at over $700 million in federal ethics disclosures, far higher than impartial estimates.

- Asserting golf courses he purchased were worth $50 million more on federal forms shortly after buying them.

- Claiming a New York vineyard he bought for just $10 million was suddenly worth between $25-50 million.

The tactic boosted Trump’s perceived net worth and ability to obtain loans. However numerous prosecutors, investigators, and journalists have presented evidence that these inflated values misrepresented assets.

Tax Fraud Allegations

Authorities have investigated Trump’s business practices several times for suspected tax fraud over the decades:

- In the 1990s, a multiyear investigation into Trump’s New York property developments revealed extensive tax evasion through schemes like concealing income and falsifying deductions. No charges were ultimately filed due to legal technicalities.

- In 2005, the FBI investigated Trump for fraudulently minimizing property values to reduce tax bills. No charges were brought.

- The IRS has sued Trump numerous times over tax disputes related to misreported income or excessive refund requests. Some cases were settled, while others were contested by Trump.

- In 2020, a major New York Times report based on obtained tax records showed Trump paid just $750 in federal income taxes in both 2016 and 2017. He appeared to exploit tax loopholes and claim dubious deductions.

While Trump has boasted of his tax acumen, he has repeatedly used dubious valuations, opaque entitles, and legal tactics to minimize tax obligations. Multiple authorities pursued fraud investigations at times as a result.

Trump University Scandal

In the early 2000s, Trump launched Trump University, a for-profit education company that purported to teach Trump’s real estate investment techniques. However, the venture quickly became mired in civil lawsuits alleging it amounted to a scam designed to steal from students. Allegations included:

- Claiming the company was an accredited “university” when it was unlicensed and unaccredited. This broke laws in several states where it operated.

- Falsely advertising Trump was handpicking instructors and involved in designing curricula – he was not actually involved.

- Students were promised extensive training but primarily only received basic seminars focused on buying more classes.

- Aggressive marketing tactics targeted elderly and retired customers, urging them to max out credit cards for mentorship programs costing up to $35,000.

After years of legal proceedings, Trump University settled the fraud lawsuits in 2017 for $25 million without admitting wrongdoing. The debacle underlined Trump’s penchant for hype, false advertising, and targeting vulnerable groups.

Financial Statement Fraud Accusations

Banks require accurate financial statements before lending large sums of money. New York prosecutors have been investigating Trump for allegedly inflating the value of assets in his statements to obtain bigger loans and better rates. For example:

- Prosecutors say Trump overstated the size of his Manhattan penthouse by a factor of three in statements to obtain loans.

- He is accused of inflating the value of his suburban New York Seven Springs Estate from $56 million up to $291 million across several statements and valuations.

- Authorities say he doubled the estimated value of his Scotland golf courses from $107 million to $235 million on paper to secure funds for purchases and operations.

While Trump claimed the values reflected his own assessments of worth, prosecutors viewed it as blatant fraud to bolster his borrowing power. The investigation has increasingly focused on criminal charges for these financial statement discrepancies.

The decades of questionable property dealings surrounding Donald Trump illustrate the nebulous legal territory between ethical business practices and real estate fraud. While Trump often escaped consequences, the pattern of inflated assets, dubious figures, and misleading marketing ultimately undermined his credibility in the eyes of authorities, business partners, and the public.

The ongoing legal probes and enforcement actions also demonstrate that even powerful figures face accountability for unethical real estate activities when evidence of systematic fraud emerges. While exploiting legal loopholes is common, outright criminal fraud in real estate often leaves a trail that can come back to haunt those involved.

Related terms: real estate agent, property owner, real estate property, straw buyer, real estate fraud cases, common real estate scams, rent payments, illegal property flipping, foreclosure fraud, mortgage fraud cases, closing costs, mortgage lender, home buying process, rental property, escrow wire fraud, fraudulent appraisal, filing forged documents, home inspection scam, mortgage scams, upfront fee, foreclosure process, property subject, California law, California penal code, bank accounts, deed fraud, selling process, down payment, federal law, assisting homeowners, rental scams, prospective tenant, federal trade commission,