A Legal Guide to Nonprofit Organizations: Tax, Compliance, and Social Impact

Introduction to Nonprofit Organizations Attorneys

Nonprofit organizations play a critical role in advancing social change by providing essential services and supporting various causes. A managing attorney can be a crucial support figure for nonprofits, offering expertise in legal matters, compliance, and operational guidance. However, navigating nonprofit law and ensuring tax-exempt status compliance can be complex. Understanding the legal framework surrounding nonprofit incorporation, governance, and financial management is essential for sustainability and success.

The Legal Framework of Nonprofits

1. Types of Nonprofit Organizations

Nonprofits can take various forms, including:

- Public charities (e.g., educational institutions, social welfare organizations)

- Private foundations (e.g., donor-advised funds)

- Religious organizations

- Social clubs

Each type has distinct regulatory and tax-exempt status requirements under 501(c) classifications.

2. Nonprofit Incorporation and Compliance

Establishing a nonprofit organization involves:

- Filing articles of incorporation

- Drafting bylaws

- Appointing board members

- Applying for federal tax-exempt status (e.g., 501(c)(3) application process)

A managing attorney can assist in the incorporation and compliance process by providing expert legal advice, ensuring all documents meet regulatory standards, and offering operational guidance tailored to the unique challenges faced by nonprofit organizations.

Legal compliance also includes state registration, reporting requirements, and laws.

Tax Considerations for Nonprofits

3. Understanding Tax-Exempt Status

To maintain tax-exempt status, tax-exempt organizations must:

- Operate exclusively for exempt purposes

- Avoid political campaigning and excessive lobbying

- Ensure financial transparency through IRS Form 990

Failing to comply can result in the revocation of 501(c)(3) status and possible taxation.

4. Navigating the Tax Exemption Process

The tax exemption process for tax exempt organizations requires:

- A strong mission statement aligning with social justice or public benefit

- Proper documentation of financial activities

- Compliance with federal tax-exempt status regulations

Legal Services and Governance for Nonprofits

5. The Role of Legal Counsel

Nonprofit organizations attorneys provide guidance on:

- Governance best practices. A managing attorney plays a crucial role in providing governance best practices, ensuring that nonprofit organizations adhere to legal and ethical standards.

- Joint ventures and partnerships

- Intellectual property protection

- Risk management and liability concerns

Legal counsel is essential in ensuring board members fulfill fiduciary duties and maintain ethical standards.

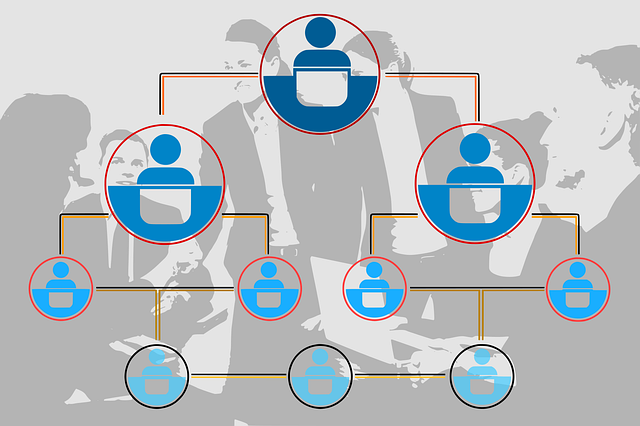

6. Board of Directors and Leadership Responsibilities

Board members must oversee the organization’s:

- Financial health

- Strategic direction

- Legal compliance. A managing attorney can play a crucial role in overseeing legal compliance, ensuring that the organization adheres to all relevant laws and regulations.

Engaging general counsel or law firms experienced in nonprofit law can help with challenges.

Social Impact and Future Trends

7. The Growth of Social Enterprises

Many nonprofit clients are exploring social work and mission-driven business models. Hybrid structures like direct service nonprofits with earned revenue models are on the rise.

8. Technology and Nonprofit Operations

Advancements in digital fundraising and donor management software are streamlining nonprofit operations, making legal compliance easier to track.

Conclusion

Navigating nonprofit law and tax-exempt status regulations is crucial for maintaining compliance and furthering mission-driven goals. With the support of nonprofit organizations attorneys, strategic planning, and adherence to legal best practices, nonprofits can maximize their social impact and ensure long-term success. A managing attorney can provide invaluable support by advising on legal matters, offering operational guidance, and serving as a resource for compliance tailored to the unique challenges faced by nonprofit organizations.

For further reading, explore our related articles:

- How to Apply for 501(c)(3) Tax-Exempt Status

- Best Legal Practices for Nonprofit Board Members

- Managing Donor-Advised Funds and Charitable Giving

For additional legal insights, refer to this nonprofit law journal.

Related Terms: tax-exempt organizations, tax-exempt entities, charitable funds, legal needs, practical solutions, holds graduate degrees,